Who doesn’t like the idea of reducing taxes and also having MORE to give?

Who doesn’t like the idea of reducing taxes and also having MORE to give?

That’s exactly why so many generous people are turning to donor-advised funds to support their giving.

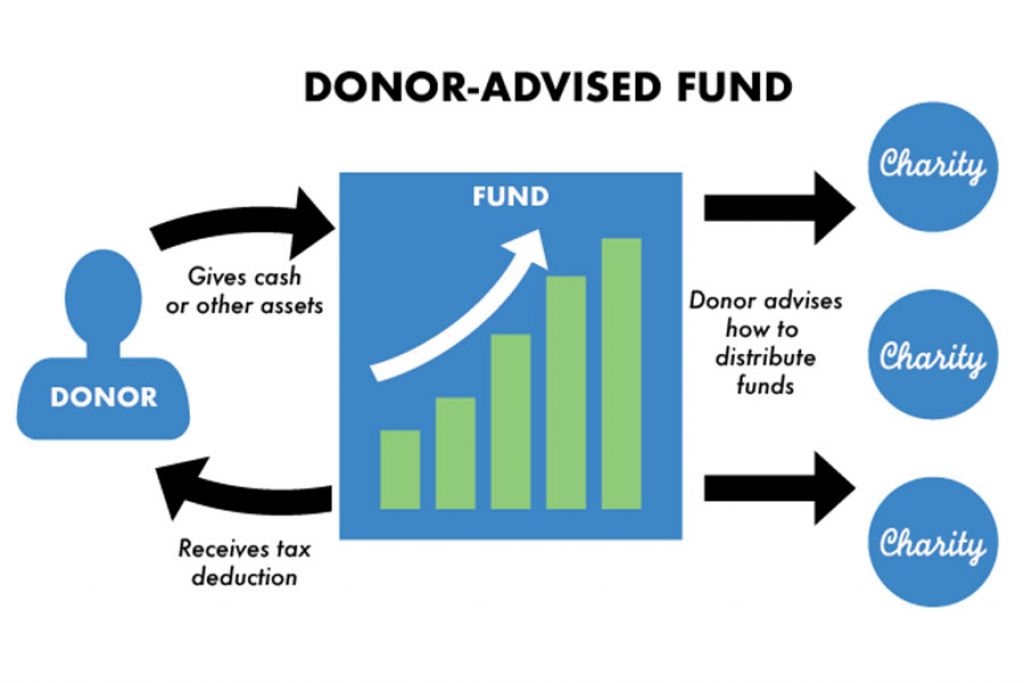

A donor-advised fund is like a charitable investment account for the sole purpose of supporting charitable organizations you care about.

When you contribute cash, securities or other assets to a donor-advised fund sponsoring organization like Fidelity Charitable, you are generally eligible to take an immediate tax deduction. Then those funds can be invested for tax-free growth, while allowing you to support charities on your timetable.